What do municipalities and food system actors need to know to maximize opportunities for impact investments, and to make the most of those investments?

On December 1st 2022, the Food Trails Impact Investors Lab hosted a webinar on “Impact investing for urban food policy actors and stakeholders.” Chaired by Joe Robertson, Senior Advisor on Sustainable Finance at EAT, the session focused on connections between financial interventions and food system innovators – with the aim of increasing financial literacy with food systems actors and the wider community.

What is impact investing? The Investors Lab defines this as the quest to “invest for impact” beyond the financial bottom line, including all actors that play a role in shaping the environment in which investment for impact is made possible and scaled up. Impact investing in sustainable urban food systems is much less common than in other urban challenges such as energy, housing and mobility.

In this webinar two complementary perspectives on the investing for impact were presented: first from the point of view of investors, and second from a Municipality and how it has attracted funds and invested in its food policy.

Dr. Helena Wright, Policy Director for the FAIRR Initiative shared prospects for investing to transform food systems.FAIRR is a network for investors that raises awareness of the environmental, social and governance (ESG) risks and opportunities brought about by intensive animal agriculture.

Helena shined some light on investors’ considerations in relation to food systems. First of all, there is a growing investor interest in food systems, but also investment risks related to climate change, freshwater supplies, deforestation, labour, health and antibiotic resistance.

Investors are trying to address those risks within their investments. There has been growing interest in investing in new technologies and sustainable protein, including plant-based food production – both from private investors andgovernments. This one impact area has measurable benefits for climate, biodiversity and other ESG-related risks.Action to reduce risk and consolidate benefits can be seen in countries setting up alternative Protein Hubs, or innovation initiatives designed to establish a position in the growing plant-based food market.

However, investors need policymakers to be able to act on food system risks: although investors are trying to address risks related to investments, they need policymakers and regulators to act on a wider array of risks, and to establish an efficient enabling and regulatory environment. An example of this is FAIRR’s call to action to the EU, to align agricultural subsidies to climate and nature goals, as investors cannot reach net zero goals without enabling policy action.

What kind of policy changes drive investment for impact? Examples at national and international levels includedisclosure of risks and climate targets by companies, as well as governments requiring zero deforestation. Municipalities can also address systemic risks through incentives that drive toward specific measurable goals and foster innovation.

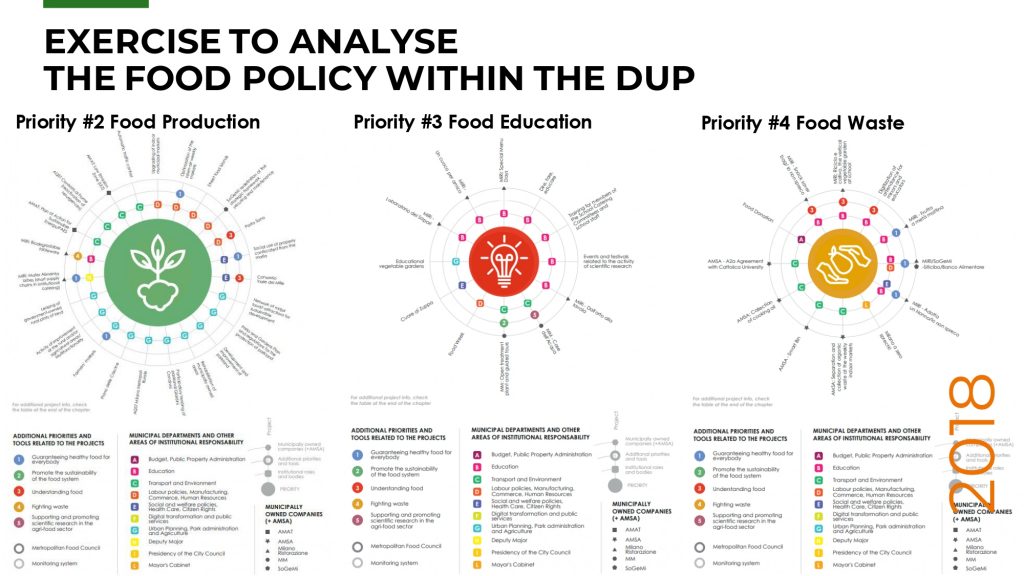

Andrea Magarini, Director of Food Policy for the City of Milan, presented the municipality’s experience on budgeting food policies, to define and direct resources to implement municipal food policy. The city started its work in 2014,defining the Municipal commitment in implementing a Food Policy, and has since been implementing related activities over the last six years.

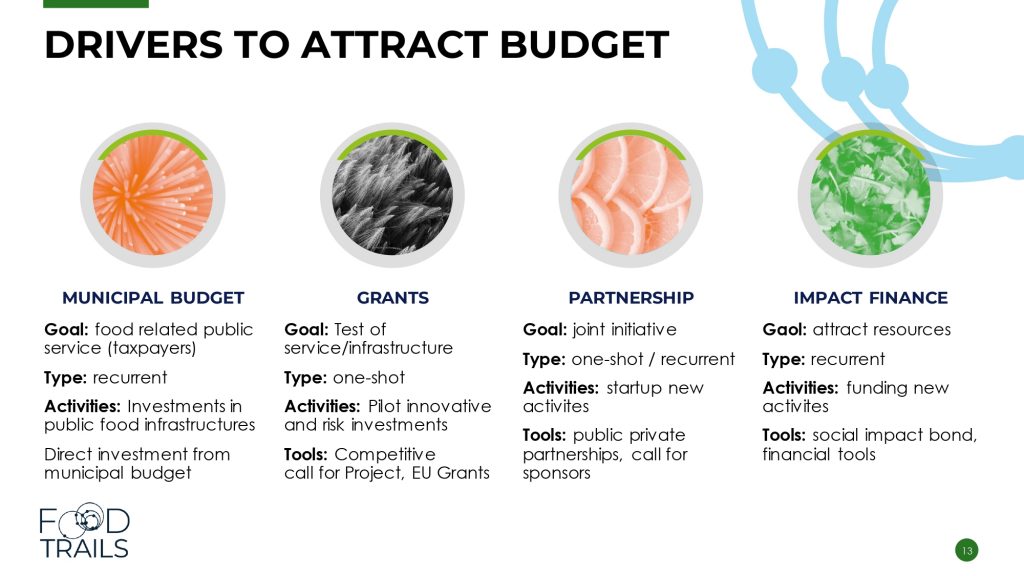

The City of Milan outlined four elements to attract funds and invest in its food policy:

- Reorient municipal budgets

- use grants

- embrace the role of grant-makers in building partnerships with food system actors

- operate as public impact investor (including tools such as social impact bonds)

Below are examples of these drivers to impact through investment:

Involving internal stakeholders to reorient existing Municipal budget to food-related services:

Milan analysed its Municipal operative program to understand internal activities and budgets in relation to food systems. The goal was to connect the various actors: internal departments (education, planning, environment, welfare), external agencies (school canteens, waste and water management, wholesale market), but also close to 250 partners and stakeholders. By connecting all stakeholders, the city has been able to reorient internal resources and implement its food policy.

Engaging external partners for investment through public-private partnerships (PPP) and sponsors:

The Metropolitan Agriculture Deal involves five agricultural districts representing 188 farmers, and works to define the governance of small actors in the food system, and connect them to public investment. In this PPP, the Municipality, Metropolitan, and regional authorities act as investors in joint infrastructure and the landscape, and farmers are also investing in short-supply chains.

The second example of a PPP is Local Food Waste Hubs, engaging public and private stakeholders to reduce food waste and establish neighbourhood initiatives. The municipality, a university, a private sector union and the grant foundation defined a model of neighbourhood networks to redistribute food losses and avoid waste. Each local hub engages different partners, which allows the investment to be shared with a wide number of actors.

While the municipality can look for external money to invest in innovative projects, the city can also act as an investor through public services, as Milan has, investing in food system infrastructures to innovate services such as school canteens, farmers markets and food aid.

About the Food Trails Impact Investors Lab

In 2022, Food Trails invited experts, investors and financial actors to participate in the project’s Investors Living Lab, together with municipalities. The Investors Lab serves as a monthly opportunity to exchange insights and experiences on a specific topic, and to help shape the production of a “Roadmap for impact investment” for urban food systems.

The developing Roadmap will look to broaden the awareness on impact investing, including the levers to improve the overall environment for investment to happen, to make change in people’s lives.

The upcoming Impact Investor Living Lab meeting schedule, as well as previous meeting notes are available here. If you are interested in joining Investors Lab meetings in 2023, please contact investorslab@eatforum.org.